MoneyWeek is a weekly magazine that enables you to become a better-informed, smarter investor and enjoy the rewards of managing your money with confidence. Week-in, week-out we'll guide you through the financial world as it changes, alerting you to all the opportunities to profit and dangers to avoid, as they appear. Income strategies, rising-star companies, the best funds and trusts, clever ways to preserve your wealth during market turmoil... you will get the best ideas from the sharpest financial minds and investing professionals in Britain.

From the editor...

The cost of feeding a king

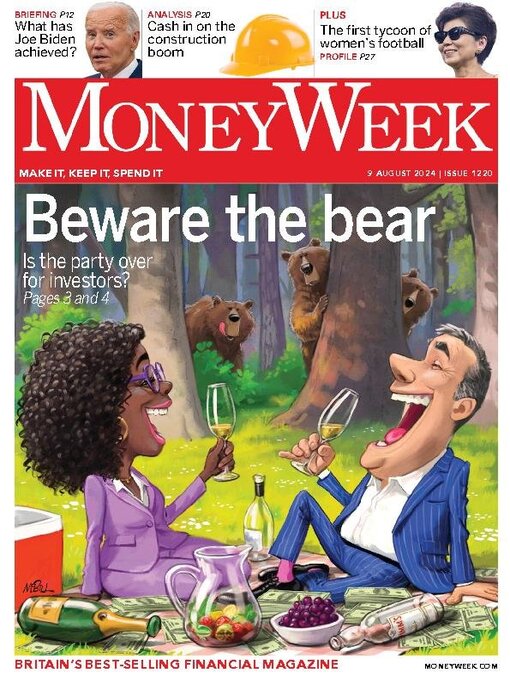

A nasty shock for complacent investors

Jump in yen crashes carry trade

Droughts bring coffee to the boil

Value and quality in Europe

Viewpoint

■ Raw materials continue post-2022 decline

Has Intel had its chips? • The semiconductor maker missed the boom in the sector thanks to its focus on PCs. Is it too late to catch up with rivals? Matthew Partridge reports

Mars bid gives Pringles more pop

Rolls-Royce keeps roaring

MoneyWeek’s comprehensive guide to this week’s share tips

A German view

IPO watch

Brace yourself for higher taxes • The government won’t raise much from the new levies it has planned, says Max King. So where will it turn next?

The risks of miscalculation • Fears of a wider Middle East war are well-founded. Matthew Partridge reports

Harris picks “plain-spoken” running mate

Betting on politics

News

The way we live now... the “tradwives” doing it for themselves

What has Joe Biden achieved? • His administration will be remembered for an industrial strategy centred on green energy and technology – along with further protectionism. Simon Wilson reports

Broken promises • The new government is already chucking out its campaign pledges to stick to the fiscal rules and avoid tax rises

City talk

Get ready for rate cuts • Central banks shouldn’t rush to lower interest rates, but it seems likely that they will cut further than expected

I wish I knew what the Sahm rule was, but I’m too embarrassed to ask

Guru watch

Best of the financial columnists

Money talks

It’s not illiberal to restrain trade

A return to the six-day week

The triumph of the slippers

Just what did we learn from Covid?

An activist approach to small caps • These two investment trusts specialise in the market’s tiddlers and are both worth buying

The Switzerland of the Caucasus • Georgia’s banks are a great way to gain exposure to this rapidly growing nation, says Dominic Frisby

How to back the winners as Britain gets building • The government’s target of building 1.5 million new homes will help house builders, but supply constraints mean that other companies could be even bigger beneficiaries, says Jamie Ward

The stocks that can cash in on a construction boom

How my tips have fared

A cross-border cash cow • Alpha Group helps clients manage risks such as foreign exchange

Trading techniques... the index effect

Stay warm this winter • State help with heating bills is being curtailed, but you may still be eligible

Losing out from lower rates

Pocket money... another crackdown on non-doms

More pay for less pension? • Some employers are offering higher salaries for lower contributions

The income-drawdown trap

News in brief... how to retire early

The best defensive consumer-staples stocks delivering consistent dividends • A professional investor tells us where he’d put his money. This week: Richard Saldanha, fund manager at Aviva Investors, highlights three promising stocks

Alex

The first...

Issue 1298-1299

Issue 1298-1299

Issue 1297

Issue 1297

Issue 1296

Issue 1296

Issue 1295

Issue 1295

Issue 1294

Issue 1294

Issue 1292-1293

Issue 1292-1293

Issue 1291

Issue 1291

Issue 1290

Issue 1290

Issue 1289

Issue 1289

Issue 1288

Issue 1288

Issue 1287

Issue 1287

Issue 1286

Issue 1286

Issue 1285

Issue 1285

Issue 1284

Issue 1284

Issue 1283

Issue 1283

Issue 1282

Issue 1282

Issue 1281

Issue 1281

Issue 1280

Issue 1280

Issue 1279

Issue 1279

Issue 1278

Issue 1278

Issue 1277

Issue 1277

Issue 1276

Issue 1276

Issue 1274-1275

Issue 1274-1275

Issue 1273

Issue 1273