MoneyWeek is a weekly magazine that enables you to become a better-informed, smarter investor and enjoy the rewards of managing your money with confidence. Week-in, week-out we'll guide you through the financial world as it changes, alerting you to all the opportunities to profit and dangers to avoid, as they appear. Income strategies, rising-star companies, the best funds and trusts, clever ways to preserve your wealth during market turmoil... you will get the best ideas from the sharpest financial minds and investing professionals in Britain.

From the editor...

Pubs are cheering

Macron’s big gamble rattles investors

Diamonds are foregone

Chip index feels more chipper

Will Korea stay cheap?

Viewpoint

■ British equities remain in bargain bin

AI boom on borrowed time • Shares in semiconductor maker Nvidia are soaring, but have they gone too far too fast? Apple, for one, is treading carefully. Matthew Partridge reports

The shine has come off Shein

Will Ashtead head to America?

MoneyWeek’s comprehensive guide to this week’s share tips

An American view

IPO watch

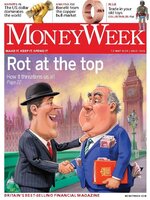

The Tories’ damp squib manifesto • Rishi Sunak’s plea for one more chance is falling on deaf ears. Emily Hohler reports

Reform UK surges ahead in the polls

The rise of the hard right • Nationalists did well in recent EU elections. Matthew Partridge reports

EU slaps tariffs on Chinese electric cars

Betting on politics

News

What we can learn from Singapore • The island nation has, since its founding in 1965, become a beacon of stability and economic progress, if not exactly of liberty or democracy. Should we emulate its example? Simon Wilson reports

The flight from woke • Texas is to get a new, liberated stock exchange. Why not Manchester or Leeds too?

City talk

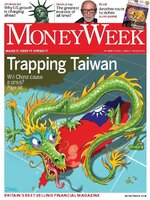

Cheap, but no catalyst • A huge slump in a long-term star market should draw bargain hunters – but Hong Kong has changed

I wish I knew what a stock split was, but I’m too embarrassed to ask

Guru watch • Mark Mobius, chair, Mobius Emerging Opportunities

Best of the financial columnists

Money talks

The return of “broad money”

The pandemic agenda rolls on

We can’t do without a car

Britons need a better dream

Buy the trusts with an edge • Investment companies are active funds – on occasion, a passive option will make more sense

Activist watch

Short positions... a three-year exodus from UK stocks

The best ways to play the energy transition • Utilities used to offer predictable returns. Now you need to tread carefully, says Rupert Hargreaves

Keep your car-hire costs down • Renting cars is complicated and pricey. There are several pitfalls for travellers to watch out for

Pocket money... the super-ATM roll-out begins

Is it time to switch fund? • Many pension options are poor performers, thanks partly to high charges

The row over the triple lock

News in brief... the cost of early retirement

Best of British stocks in the bargain basement offer income and growth • A professional investor tells us where he’d put his money. This week: Callum Abbot, portfolio manager of the JPMorgan Claverhouse Investment Trust

Alex

A punt on PayPal will pay off • The group has added strings to its bow and looks reasonably valued

Trading techniques... reverse stock splits

How my tips have fared

Nigel Farage is back • The man most responsible for Britain’s seismic exit from the EU has made a noisy re-entry into politics to shake up the general election. The aim is a “reverse takeover” of the Tory party. Jane Lewis reports

Britain’s Bill Gates...

1232

1232

1231

1231

1230

1230

1229

1229

1228

1228

1227

1227

1226

1226

1225

1225

1224

1224

1222

1222

1221

1221

1220

1220

1219

1219

1218

1218

1217

1217

1216

1216

1215

1215

1214

1214

1213

1213

1212

1212

1211

1211

1209

1209

1208

1208

1207

1207