MoneyWeek is a weekly magazine that enables you to become a better-informed, smarter investor and enjoy the rewards of managing your money with confidence. Week-in, week-out we'll guide you through the financial world as it changes, alerting you to all the opportunities to profit and dangers to avoid, as they appear. Income strategies, rising-star companies, the best funds and trusts, clever ways to preserve your wealth during market turmoil... you will get the best ideas from the sharpest financial minds and investing professionals in Britain.

From the editor...

Japan finally ejects floppy disks

The AI boom is on borrowed time

US growth is on the wane

UK gilts regain their appeal

British stocks due a bounce

Viewpoint

■ Middle Kingdom targets Western consumers

Burberry is out of fashion • The luxury group’s attempt to go upmarket appears to have failed, denting sales and rattling investors. What now? Matthew Partridge reports

Ocado delivers good news for once

Alphabet shops for cybersecurity

MoneyWeek’s comprehensive guide to this week’s share tips

A German view

IPO watch

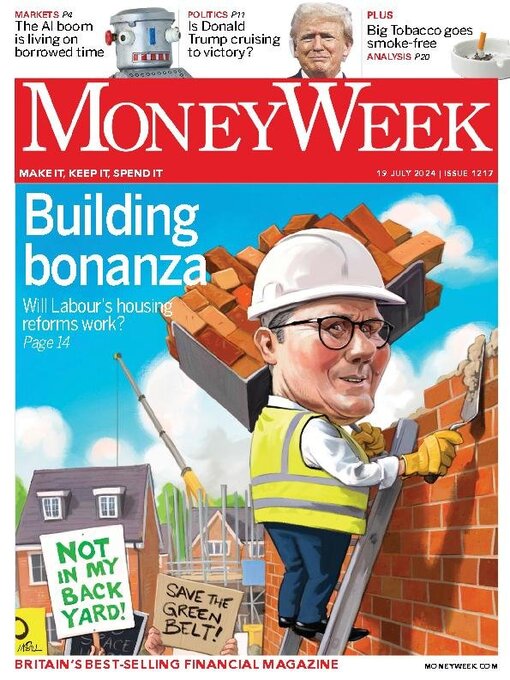

Taking the brakes off Britain • Keir Starmer has unveiled his blueprint, but much remains unclear. Emily Hohler reports.

Fixing the prison crisis

Violence and polarisation • An unsettling election has taken another dark turn. Matthew Partridge reports

Nato’s uncertain future

Betting on politics

News

The way we live now... an Olympic Games on steroids

Starmer’s battle with the blockers • Labour wants to see 1.5 million homes built in five years. Will it happen? Simon Wilson reports

Good riddance to Bidenomics • Joe Biden will not be re-elected and America will be better off without his wasteful economic policies

City talk

An improving outlook • UK mid caps have perked up and the rally may run further, but long-term investors should remain selective

I wish I knew what real assets was, but I’m too embarrassed to ask

Guru watch

A green trust to tuck away • The ESG bubble has burst, but environmental technology is still a long-term opportunity

Activist watch

Short positions... record outflows from UK funds

Best of the financial columnists

Money talks

The Fed fumbles in the dark

AI will not save the economy…

Britain’s capo dei capi

… nor will it save the NHS

The tobacco industry is going smoke-free • Cigarette manufacturers have realised their traditional products are on the wane. But new opportunities have opened up – and should prove highly lucrative, says Rupert Hargreaves

Who’s who in global tobacco

Means-testing the state pension... • ... would prove vastly complicated and intrusive, says Merryn Somerset Webb

It’s high time to get creative • Any industrial strategy should not overlook one of our top national assets, says David C. Stevenson

Move your savings now • We don’t make our money work hard enough. Act fast to lock in a good rate

Avoid extras in parking apps

Pocket money... beavers reduce insurance costs

A boost from the state • The new Growth Guarantee Scheme could help you grow your company

Seek out higher interest rates

Petty cash... how to register for VAT

Profit from the push for growth • Mercia Asset Management helps the government funds smaller companies in Britain’s regions

Europe’s most competitive stocks will enjoy sustainable profit growth • A professional investor tells us where he’d put his money. This week: Marcel Stötzel, co-portfolio manager of the Fidelity European Trust, selects three stocks

Alex

Ferocious fintech...

1232

1232

1231

1231

1230

1230

1229

1229

1228

1228

1227

1227

1226

1226

1225

1225

1224

1224

1222

1222

1221

1221

1220

1220

1219

1219

1218

1218

1217

1217

1216

1216

1215

1215

1214

1214

1213

1213

1212

1212

1211

1211

1209

1209

1208

1208

1207

1207